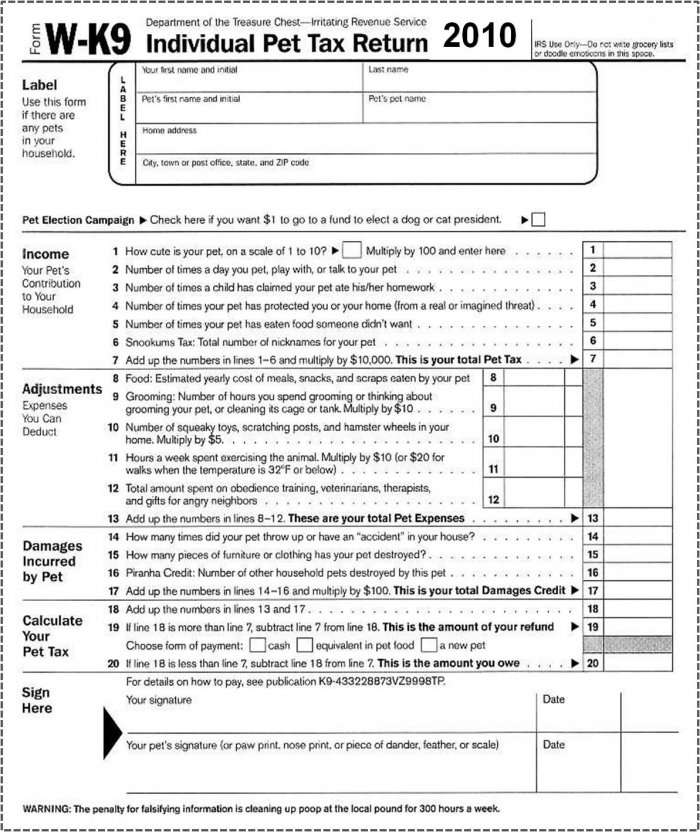

W-K9 Individual Pet Tax Return

The W-K9 Individual Pet Tax Return below should be filled out and signed by both the owner and their pet in order to receive the full tax benefits and credits offered for responsible pet ownership.

Jump to "Real Tax Breaks For Pets"

Although the above pet tax return is not for real, there is... Leo's Bill:

Humanity and Pets Partnered Through the Years Act ~ HAPPY Act

HR 3501 IH

111th CONGRESS

1st Session

H. R. 3501

This bill wants the Internal Revenue Code of 1986 to be amended in order to allow a deduction for pet care expenses.

Official Summary

7/31/2009--Introduced. Humanity and Pets Partnered Through the Years

(HAPPY) Act - To amend the Internal Revenue Code of 1986 (relating to

additional itemized deductions for individuals) to allow a deduction for

pet care expenses, up to $3,500 per year, for pet care expenses,

including veterinary care.

- According to the 2007-2008 National Pet Owners Survey, 63 percent of United States households own a pet.

- The Human-Animal Bond has been shown to have positive effects upon people's emotional and physical well-being. Animal welfare activist Leo Grillo got Rep. Thaddeus McCotter (R-MI) to introduce to Congress H.R. 3501, a tax-exemption for pet owners.

- The Maximum Deduction allowable to the taxpayer for any taxable year shall not exceed $3,500 for a Qualified Pet.

- Qualified Pet Care Expenses means amounts paid in connection with providing care (including veterinary care) for a qualified pet other than any expense in connection with the acquisition of the qualified pet. The term QUALIFIED PET means a legally owned, domesticated, live animal.

IN THE HOUSE OF REPRESENTATIVES......... July 31, 2009

"Given the benefits pets provide to our emotional and physical health, the time has come to include pet exemptions in the tax code." Robert Davi

Tax Break for Pets

Caring for our pets is costly... Food, veterinarian care, grooming, dental care, training, pet sitting, emergency medical care, and the list goes on and on.... it all really adds up. And while many of us think of our pets as family members, the IRS does not, so no deductions. But wait, not so fast...

There are some circumstances where you might just be able to qualify for a *pet tax deduction when you itemize your expenses. Here are just a few:

- Service Animals for the Disabled: Service dogs are considered a medical expense to the disabled, so the cost of feeding, training, caring, and maintaining their overall well-being, will qualify as a tax deduction.

- My Pet is a Business: If your pet is actually a business (a working dog) you will qualify for certain deductions. Here are just a few types of real animal jobs we're talking about... Sled dog, bomb sniffing dog, tracking dog, guard dog, animal actor, hunting dog, pet model, therapy dog.

- Foster Parent: If you are a fostering an animal for a nonprofit 501(c)(3) organization then the costs you incur by providing food, medical treatment, and the like to the foster pet in your care, can be claimed as a deduction. Besides keeping all your receipts, obtain documentation from the rescue organization confirming your volunteer/work position as a foster parent.

- Pet Businesses: Of course if you run a pet business such as a pet portrait studio, dog groomer, pet-sitter, pet store, pet boarding, dog walker, dog trainer, and so on... you will have viable deductions. But in order to claim expenses for your own pet, your pet must be a necessary and regular part of your business expenses. ie a working animal (See #2). or you may qualify as a breeder if you have all the necessary permits, complete records on each dog, etc (ie. not a hobby breeder).

*Please note: The information provided is not meant as legal or tax advice. Please contact a qualified tax advisior to determine if any of this information may apply to your own situation.

Go from Pet Tax Return to About the Miniature Schnauzer on Schnauzers Rule

Go from Pet Tax Return to Dog Jokes

Hide a Squirrel

Schnauzer Tested and Approved Dog Toy: Hide a Squirrel on AMAZON

GET HEALTHY

Great deals on vitamins for your pet!

Note: I earn a small commission from qualifying purchases.

Veterinary Strength Shampoo for Dogs

helps destroy bacteria and fungi that cause skin infections

and Schnauzer Bumps

Mini Schnauzer Family Sun Shade for your car's windshield. So dang cute

Schnauzers Rule on Zazzle

Schnauzers Rule Zazzle Shop

Be sure to visit our Zazzle store. We have lots gifts for Miniature Schnauzer Lovers including T Shirts, Stickers, Home Decor items and more. Got Schnauzer?

Get Social with Us

Follow Schnauzers Rule @luvdaSchnauzers

GOOGLE PLUS ONE We would love for you to +1 pages you like throughout our website. It lets Google know you found a particular page interesting... which in turn, helps others find our information on Miniature Schnauzers! Thanks for helping us out and for being a loyal visitor. Aroo!

Follow our board on Pinterest

Special Promotional Offers

Check out all the cute dog customers on AMAZON

Amazon purchases through affiliate links, earn me a small commission